Essay

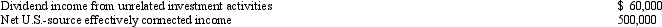

BrazilCo,Inc. ,a foreign corporation with a U.S.trade or business,has U.S.-source income as follows.

Determine BrazilCo's total U.S.tax liability for the year assuming a 35% corporate rate and no tax treaty.Assume BrazilCo leaves its U.S.branch profits invested in the United States and does not otherwise repatriate any of its U.S.assets during the year.

Determine BrazilCo's total U.S.tax liability for the year assuming a 35% corporate rate and no tax treaty.Assume BrazilCo leaves its U.S.branch profits invested in the United States and does not otherwise repatriate any of its U.S.assets during the year.

Correct Answer:

Verified

BrazilCo's U.S.tax l...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q56: Yosef Barbutz,an NRA,is employed by Fisher,Inc. ,a

Q58: The green card remains in effect until:<br>A)The

Q59: Arendt, Inc., a domestic corporation, purchases a

Q62: U.S.individuals that receive dividends from foreign corporations

Q63: ForCo,a foreign corporation,receives interest income of $100,000

Q65: Peanut,Inc. ,a domestic corporation,receives $500,000 of foreign-source

Q103: A nonresident alien is defined as someone

Q110: Monika, a nonresident alien, is employed by

Q136: In which of the following independent situations

Q148: Which of the following statements regarding income