Essay

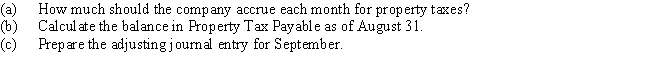

On January 1,Newman Company estimated its property tax to be $5,100 for the year.

Correct Answer:

Verified

(a) $425

...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

(a) $425

...

...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q9: On December 15, Great Designs Company hired

Q19: The unearned rent account has a balance

Q20: The account type and normal balance of

Q24: Deferred revenue is revenue that is<br>A) earned

Q26: The adjustment for accrued fees was debited

Q101: An example of deferred revenue is Unearned

Q140: Prior to the adjusting process, accrued revenue

Q182: Revenues and expenses should be recorded in

Q204: Accrued salaries of $600 owed to employees

Q208: Ski Master Company pays weekly salaries of