Essay

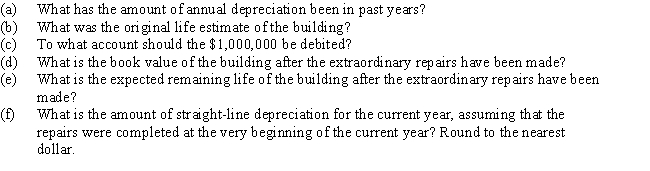

A number of major structural repairs completed at the beginning of the current fiscal year at a cost of $1,000,000 are expected to extend the life of a building 10 years beyond the original estimate.The original cost of the building was $6,552,000,and it has been depreciated by the straight-line method for 25 years.Estimated residual value is negligible and has been ignored.The related accumulated depreciation account after the depreciation adjustment at the end of the preceding fiscal year is $4,550,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: The depreciable cost of a building is

Q23: The book value of a fixed asset

Q73: Both the initial cost of the asset

Q93: On December 31, Strike Company sold one

Q104: Classify each of the following costs associated

Q113: A fixed asset with a cost of

Q134: Xtra Company purchased a business from Argus

Q137: The term applied to the amount of

Q170: Computer equipment was acquired at the beginning

Q193: The amount of depreciation expense for the