Essay

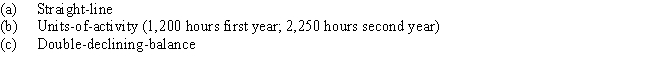

Equipment purchased at the beginning of the fiscal year for $360,000 is expected to have a useful life of five years,or 14,000 operating hours,and a residual value of $10,000.Compute the depreciation for the first and second years of use by each of the following methods:

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Expenditures that increase operating efficiency or capacity

Q8: Weber Company purchased a mining site for

Q71: Prior to adjustment at the end of

Q72: Champion Company purchased and installed carpet in

Q74: Carter Co.acquired drilling rights for $18,550,000.The oil

Q76: Computer equipment <br>(office equipment)purchased 6½ years ago

Q78: When a seller allows a buyer an

Q94: The natural resources of some companies include<br>A)

Q116: During construction of a building, the cost

Q166: On June 1, Michael Company purchased equipment