Essay

Machinery acquired at a cost of $80,000 and on which there is accumulated depreciation of $55,000

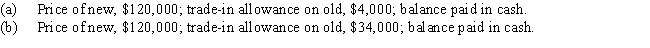

(including depreciation for the current year to date)is exchanged for similar machinery.Assume that the transaction has commercial substance.For financial reporting purposes,present entries to record the exchange of the machinery under each of the following assumptions:

Correct Answer:

Verified

Correct Answer:

Verified

Q13: Classify each of the following costs associated

Q35: Match the intangible assets described with their

Q77: Residual value is also known as all

Q88: The higher the fixed asset turnover, the<br>A)

Q112: Sands Company purchased mining rights for $500,000.

Q139: Identify the following as a fixed asset

Q140: Convert each of the following estimates of

Q162: Classify each of the following costs associated

Q183: The cost of new equipment is called

Q189: The double-declining-balance method of depreciation uses a