Multiple Choice

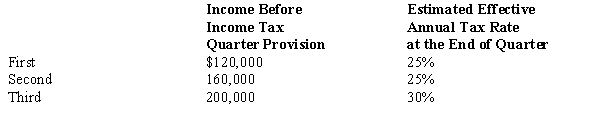

Bjork,a calendar year company,has the following income before income tax provision and estimated effective annual income tax rates for the first three quarters of 2017:  Bjork's income tax provision in its interim income statement for the third quarter should be

Bjork's income tax provision in its interim income statement for the third quarter should be

A) $74,000.

B) $60,000.

C) $50,000.

D) $144,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: An enterprise determines that it must report

Q12: Which of the following statements most accurately

Q13: Inventory losses from market declines that are

Q15: An entity is permitted to aggregate operating

Q24: Which of the following disclosures is NOT

Q29: During the second quarter of 2017, Clearwater

Q37: XYZ Corporation has eight industry segments with

Q39: Blink Company,which uses the FIFO inventory method,had

Q41: The following information is available for Pink

Q44: An entity is permitted to aggregate operating