Essay

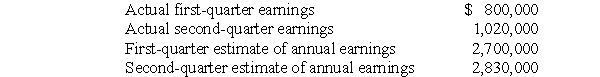

Itchy Company's actual earnings for the first two quarters of 2017 and its estimate during each quarter of its annual earnings are:

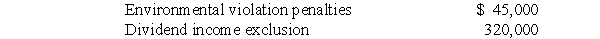

Itchy Company estimated its permanent differences between accounting income and taxable income for 2017 as:

Itchy Company estimated its permanent differences between accounting income and taxable income for 2017 as:

These estimates did not change during the second quarter.The combined state and federal tax rate for Itchy Company for 2017 is 40%.

These estimates did not change during the second quarter.The combined state and federal tax rate for Itchy Company for 2017 is 40%.

Required:

Prepare journal entries to record Itchy Company's provisions for income taxes for each of the first two quarters of 2017.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: For interim financial reporting, the effective tax

Q8: The computation of a company's third quarter

Q20: Stein Corporation's operations involve three industry segments,X,Y,and

Q22: To determine whether a substantial portion of

Q23: For external reporting purposes, it is appropriate

Q26: Determine the amount of revenue for each

Q31: Selected data for a segment of a

Q35: For interim financial reporting, a company's income

Q37: In considering interim financial reporting, how did

Q42: Companies using the LIFO method may encounter