Multiple Choice

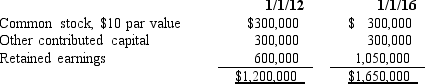

On January 1,2012,Pine Corporation purchased 24,000 of the 30,000 outstanding common shares of Summit Company for $1,140,000.On January 1,2016,Pine Corporation sold 3,000 of its shares of Summit Company on the open market for $90 per share.Summit Company's stockholders' equity on January 1,2012,and January 1,2016,was as follows:  The difference between implied and book value is assigned to Summit Company's land.As a result of the sale,Pine Corporation's Investment in Summit account should be credited for:

The difference between implied and book value is assigned to Summit Company's land.As a result of the sale,Pine Corporation's Investment in Summit account should be credited for:

A) $165,000.

B) $206,250.

C) $120,000.

D) $142,500.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Parr Company owned 24,000 of the 30,000

Q12: When the parent company sells a portion

Q13: On January 1 2016, Paulus Company purchased

Q15: The computation of noncontrolling interest in net

Q16: A parent's ownership percentage in a subsidiary

Q17: Pamela Company acquired 80% of the outstanding

Q23: Under the partial equity method, the workpaper

Q25: If a portion of an investment is

Q27: On January 1, 2016, P Corporation purchased

Q29: On January 1, 2014, Panel Company acquired