Essay

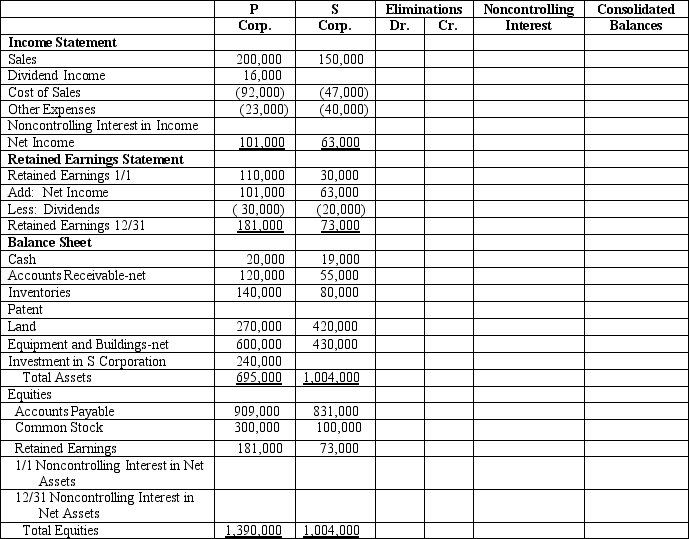

P Corporation acquired 80% of S Corporation on January 1,2017 for $240,000 cash when S's stockholders' equity consisted of $100,000 of Common Stock and $30,000 of Retained Earnings.The difference between the price paid by P and the underlying equity acquired in S was allocated solely to a patent amortized over 10 years.

P sold merchandise to S during the year in the amount of $30,000.$10,000 worth of inventory is still on hand at the end of the year with an unrealized profit of $4,000.The separate company statements for P and S appear in the first two columns of the partially completed consolidated workpaper.

Required:

Complete the consolidated workpaper for P and S for the year 2017.

P Corporation and Subsidiary

Consolidated Statements Workpaper

December 31,2017

December 31,2017

Correct Answer:

Verified

6-6 P Corporation an...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: On January 1,2017,Perch Company purchased an 80%

Q2: P Company owns an 80% interest in

Q3: The following balances were taken from the

Q4: P Company owns an 80% interest in

Q5: P Company owns an 80% interest in

Q7: P Company regularly sells merchandise to its

Q8: P Company regularly sells merchandise to its

Q9: P Company regularly sells merchandise to its

Q10: Pine Company owns an 80% interest in

Q26: A 90% owned subsidiary sold merchandise at