Essay

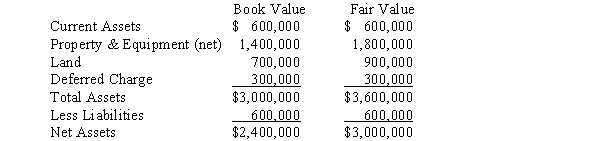

Plain Corporation acquired a 75% interest in Swampy Company on January 1,2016,for $2,000,000.The book value and fair value of the assets and liabilities of Swampy Company on that date were as follows:

The property and equipment had a remaining life of 6 years on January 1,2016,and the deferred charge was being amortized over a period of 5 years from that date.Common stock was $1,500,000 and retained earnings was $900,000 on January 1,2016.Plain Company records its investment in Swampy Company using the cost method.

The property and equipment had a remaining life of 6 years on January 1,2016,and the deferred charge was being amortized over a period of 5 years from that date.Common stock was $1,500,000 and retained earnings was $900,000 on January 1,2016.Plain Company records its investment in Swampy Company using the cost method.

Required:

Prepare,in general journal form,the December 31,2016,workpaper entries necessary to:

A.Eliminate the investment account.

B.Allocate and amortize the difference between implied and book value.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Under which set of circumstances would it

Q7: Primer Company acquired an 80% interest in

Q11: Pennington Corporation purchased 80% of the voting

Q12: On January 1,2016,Poole Company purchased 75% of

Q15: On January 1,2016,Pamela Company purchased 75% of

Q15: Pulman Company acquired 90% of the stock

Q21: Phillips Company purchased a 90% interest in

Q25: If the fair value of the subsidiary's

Q29: In preparing consolidated working papers, beginning retained

Q36: When the implied value exceeds the aggregate