Essay

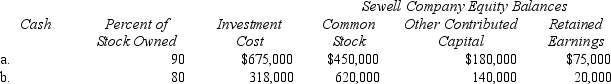

Prepare in general journal form the workpaper entries to eliminate Porter Company's investment in Sewell Company in the preparation of a consolidated balance sheet at the date of acquisition for each of the following independent cases:

Any difference between book value of net assets acquired and the value implied by the purchase price relates to subsidiary property,plant,and equipment except for case (b).In case (b)assume that all book values and fair values are the same.

Any difference between book value of net assets acquired and the value implied by the purchase price relates to subsidiary property,plant,and equipment except for case (b).In case (b)assume that all book values and fair values are the same.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Price Company acquired 75 percent of the

Q7: Eliminating entries are made to cancel the

Q14: In which of the following cases would

Q17: On December 31,2016,Pinta Company purchased 80% of

Q18: On December 31,2016,Priestly Company purchased a controlling

Q19: On January 1,2016,Pell Company and Sand Company

Q23: P Corporation paid $420,000 for 70% of

Q25: On January 2,2016,Pope Company acquired 90% of

Q26: On January 1,2016,Pell Company and Sand Company

Q36: The Difference between Implied and Book Value