Essay

Maplewood Corporation purchased the net assets of West Corporation on January 2,2016 for $560,000 and also paid $20,000 in direct acquisition costs.West's balance sheet on January

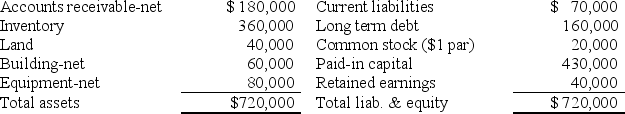

1,2016 was as follows:

Fair values agree with book values except for inventory,land,and equipment,which have fair values of $400,000,$50,000 and $70,000,respectively.West has patent rights valued at $20,000.

Fair values agree with book values except for inventory,land,and equipment,which have fair values of $400,000,$50,000 and $70,000,respectively.West has patent rights valued at $20,000.

Required:

A.Prepare Maplewood's general journal entry for the cash purchase of West's net assets.

B.Assume Maplewood Corporation purchased the net assets of West Corporation for $500,000 rather than $560,000,prepare the general journal entry.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: SFAS 141R requires that the acquirer disclose

Q10: Following its acquisition of the net assets

Q11: North Company issued 24,000 shares of its

Q16: In a leveraged buyout, the portion of

Q17: Balance sheet information for Hope Corporation at

Q18: SFAS No. 142 requires that goodwill impairment

Q20: North Company issued 24,000 shares of its

Q31: A business combination is accounted for properly

Q39: The fair value of net identifiable assets

Q40: The fair value of net identifiable assets