Essay

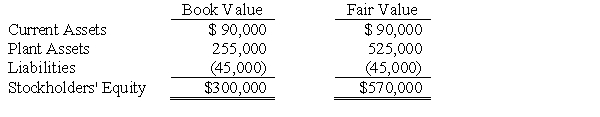

The managers of Savage Company own 10,000 of its 100,000 outstanding common shares.Swann Company is formed by the managers of Savage Company to take over Savage Company in a leveraged buyout.The managers contribute their shares in Savage Company and Swann Company then borrows $675,000 to purchase the remaining 90,000 shares of Savage Company for $600,000; the remaining $75,000 is used for working capital.Savage Company is then merged into Swann Company effective January 1,2016.Data relevant to Savage Company immediately prior to the leveraged buyout follow:

Required:

Required:

A.Prepare journal entries on Swann Company's books to reflect the effects of the leveraged buyout.

B.Determine the balance of each of the following immediately after the merger:

1.Current Assets

2.Plant Assets

3.Note Payable

4.Common Stock

Correct Answer:

Verified

_TB4284_00...

_TB4284_00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: P Co. issued 5,000 shares of its

Q11: Parental Company and Sub Company were combined

Q16: In a leveraged buyout, the portion of

Q20: North Company issued 24,000 shares of its

Q23: P Company acquires all of the voting

Q25: Porpoise Corporation acquired Sims Company through an

Q26: The fair value of assets and liabilities

Q27: In a period in which an impairment

Q33: If the value implied by the purchase

Q40: The fair value of net identifiable assets