Essay

Hopkins Company is considering the acquisition of Richfield,Inc.To assess the amount it might be willing to pay,Hopkins makes the following computations and assumptions.

A.Richfield,Inc.has identifiable assets with a total fair value of $6,000,000 and liabilities of $3,700,000.The assets include office equipment with a fair value approximating book value,buildings with a fair value 25% higher than book value,and land with a fair value 50% higher than book value.The remaining lives of the assets are deemed to be approximately equal to those used by Richfield,Inc.

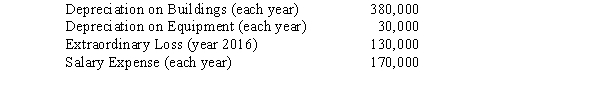

B.Richfield,Inc.'s pretax incomes for the years 2014 through 2016 were $470,000,$570,000,and $370,000,respectively.Hopkins believes that an average of these earnings represents a fair estimate of annual earnings for the indefinite future.However,it may need to consider adjustments for the following items included in pretax earnings:

C.The normal rate of return on net assets for the industry is 15%.

C.The normal rate of return on net assets for the industry is 15%.

Required:

A.Assume that Hopkins feels that it must earn a 20% return on its investment,and that goodwill is determined by capitalizing excess earnings.Based on these assumptions,calculate a reasonable offering price for Richfield,Inc.Indicate how much of the price consists of goodwill.

B.Assume that Hopkins feels that it must earn a 15% return on its investment,but that average excess earnings are to be capitalized for five years only.Based on these assumptions,calculate a reasonable offering price for Richfield,Inc.Indicate how much of the price consists of goodwill.

Correct Answer:

Verified

A.Normal earnings for similar firms = ($...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q13: The objectives of FASB 141R (Business Combinations)

Q14: A firm can use which method of

Q23: When following the economic unit concept in

Q24: Many of FASB's recent pronouncements indicate a

Q29: The excess of the amount offered in

Q31: The difference between normal earnings and expected

Q32: The first step in estimating goodwill in

Q33: When a new corporation is formed to

Q34: Under the economic unit concept, noncontrolling interest

Q35: A business combination in which the boards