Essay

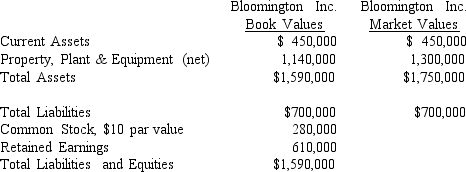

Eden Company is trying to decide whether to acquire Bloomington Inc.The following balance sheet for Bloomington Inc.provides information about book values.Estimated market values are also listed,based upon Eden Company's appraisals.

Eden Company expects that Bloomington will earn approximately $290,000 per year in net income over the next five years.This income is higher than the 14% annual return on tangible assets considered to be the industry "norm."

Eden Company expects that Bloomington will earn approximately $290,000 per year in net income over the next five years.This income is higher than the 14% annual return on tangible assets considered to be the industry "norm."

Required:

A.Compute an estimation of goodwill based on the information above that Eden might be willing to pay (include in its purchase price),under each of the following additional assumptions:

(1)Eden is willing to pay for excess earnings for an expected life of 4 years (undiscounted).

(2)Eden is willing to pay for excess earnings for an expected life of 4 years,which should be

capitalized at the industry normal rate of return.

(3)Excess earnings are expected to last indefinitely,but Eden demands a higher rate of return of

20% because of the risk involved.

B.Determine the amount of goodwill to be recorded on the books if Eden pays $1,300,000 cash and assumes Bloomington's liabilities.

Correct Answer:

Verified

A.Normal earnings for similar firms (bas...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: The two alternative views of consolidated financial

Q3: Estimating the value of goodwill to be

Q4: The third period of business combinations started

Q7: Stock given as consideration for a business

Q10: The impairment standard as it relates to

Q15: Under the parent company concept, consolidated net

Q20: When following the parent company concept in

Q22: Which of the following is not a

Q25: The defense tactic that involves purchasing shares

Q44: Which of the following situations best describes