Essay

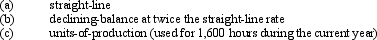

Machinery is purchased on July 1 of the current fiscal year for $240,000. It is expected to have a useful life of 4 years, or 25,000 operating hours, and a residual value of $15,000. Compute the depreciation for the last six months of the current fiscal year ending December 31 by each of the following methods:

Correct Answer:

Verified

(Round the...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: When the amount of use of a

Q18: A copy machine acquired on March 1,

Q20: Identify the following as a Fixed Asset

Q21: On July 1, 2010, Howard Co. acquired

Q35: The depreciation method that does not use

Q41: A used machine with a purchase price

Q65: The Weber Company purchased a mining site

Q101: When old equipment is traded in for

Q139: Golden Sales has bought $135,000 in fixed

Q180: Though a piece of equipment is still