Essay

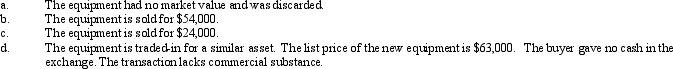

Equipment acquired at a cost of $126,000 has a book value of $42,000. Journalize the disposal of the equipment under the following independent assumptions.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q9: The cost of computer equipment does include

Q24: The most widely used depreciation method is<br>A)

Q33: Falcon Company acquired an adjacent lot to

Q43: Which of the following is included in

Q73: Which intangible assets are amortized over their

Q128: Journalize each of the following transactions:<br> <img

Q137: On July 1st, Harding Construction purchases a

Q140: An estimate of the amount which an

Q151: When a company establishes an outstanding reputation

Q212: A characteristic of a fixed asset is