Essay

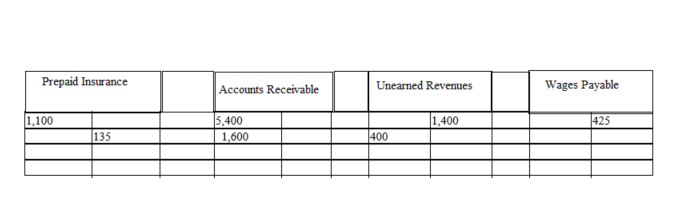

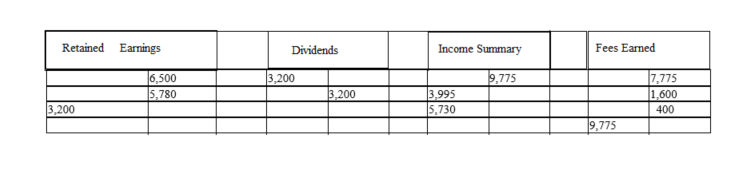

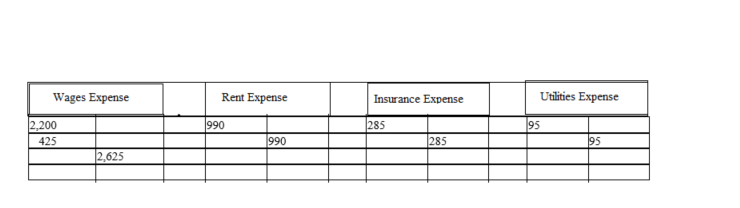

Prepare an income statement and a retained earnings statement for the month ended August 31, 2014, from the following T accounts of Marley Company.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q134: Identify which of the following accounts should

Q135: Capital Stock and Dividends are reported in

Q138: The following is the adjusted trial balance

Q139: What is the major difference between the

Q141: The balances for the accounts listed below

Q142: The worksheet and the financial statements both

Q142: A summary of selected ledger accounts appear

Q153: Cash and other assets that may reasonably

Q175: After all of the account balances have

Q200: Examples of temporary accounts are supplies and