Essay

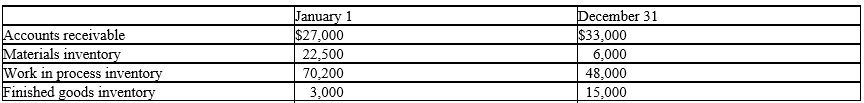

Rosalba Manufacturing Company had the following account balance for 2012:

Collections on account were $625,000 in 2012.

Collections on account were $625,000 in 2012.

Cost of goods sold was 68% of sales.

Direct materials purchased amounted to $90,000.

Factory overhead was 300% of the cost of direct labor.

Compute:

a) sales revenue (all sales were on account)

b) cost of goods sold

c) cost of goods manufactured

d) direct labor incurred

e) direct materials used

f) factory overhead incurred

Correct Answer:

Verified

a) $33,000 + $625,000 - $27,000 = $631,0...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q10: Cost of goods manufactured during 2011 is

Q15: Conversion costs are<br>A) direct materials and direct

Q64: Cost of Materials Used $45,000 Direct Labor

Q68: Cost of Materials Used $45,000 Direct Labor

Q69: Classify the following costs as either a

Q70: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2083/.jpg" alt=" What is the amount

Q98: Rent expense incurred on a factory building

Q137: Costs on the income statement for both

Q143: Control is the process of monitoring operating

Q191: Managerial accounting information includes both historical and