Essay

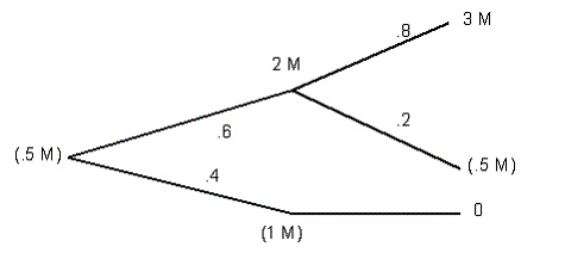

Komarek Forests is considering a new software package that may improve productivity over the next two years. There is a sixty percent chance that the project will be a success in Year 1, earning $2 million and a forty percent change that the venture will fail during the first year resulting in a $1 million loss due to worse asset management than under the current system. The original system would be reinstalled, resulting in no additional losses during the second year.

If the project is a success in the first year, there is an eighty percent chance that it will earn $3 million in the second year. There is a twenty percent chance that the software will be ineffective in Year 2, despite success in Year 1, in which case there would be a loss of $500,000. Assuming a nine percent required rate of return on these, and a total cost of the software system of $500,000, should Komarek install the new system?

Correct Answer:

Verified

Path 1:

Probability: 0.6 ´ 0.8 = 0.48

CF...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Probability: 0.6 ´ 0.8 = 0.48

CF...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q10: Risk in cash flow estimating for capital

Q24: What is Monte Carlo simulation? How is

Q30: Which of the following is not a

Q33: Scenario/sensitivity analysis is a procedure that can

Q36: An abandonment option will have an upfront

Q39: If a firm adopts a large proportion

Q46: Muller, Inc., manufacturer of cardboard boxes, is

Q52: Risk can be incorporated into capital budgeting

Q61: Decision tree analysis let us approximate the

Q68: A real option's value may be more