Multiple Choice

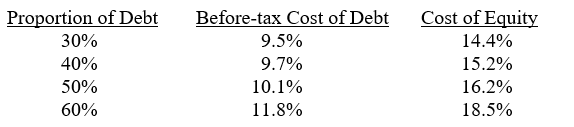

Takeoka's Sushi To Go has estimated the following cost of debt before-tax) and cost of equity.

What is the cost of capital at Takeoka's optimal capital structure given the above information and a 40% effective tax rate?

A) 10.78%

B) 11.02%

C) 11.13%

D) 11.45%

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Financial risk is the basic risk inherent

Q11: What is a firm's capital structure?<br>A)a firm's

Q12: How does high business risk affect firm

Q13: Increasing financial leverage decreases the volatility of

Q14: An optimal capital structure minimizes a firm's

Q16: Bankruptcy costs are one type of financial

Q17: Fixed cost sources of financing include both

Q18: Luther's Famous Barbeque has estimated the following

Q19: Which of the following is most likely

Q20: An investment banking firm has estimated the