Multiple Choice

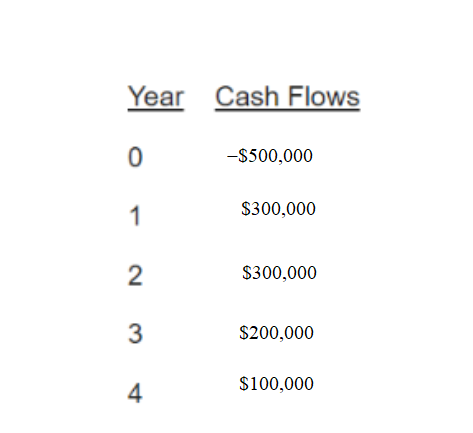

A capital budgeting project is expected to have the following cash flows:

What is the project's net present value at a 12% required rate of return?

A) $212,923

B) $200,373

C) $225,868

D) $276,475

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q5: What is the profitability index for an

Q6: A capital budgeting project's internal rate of

Q7: The net present value, profitability index, internal

Q8: A capital budgeting project has a net

Q9: The discounted payback period does not take

Q11: If a project's internal rate of return

Q12: A project's payback period is the amount

Q13: A project's net present value is the

Q14: The net present value is the ratio

Q15: A capital budgeting project has a net