Multiple Choice

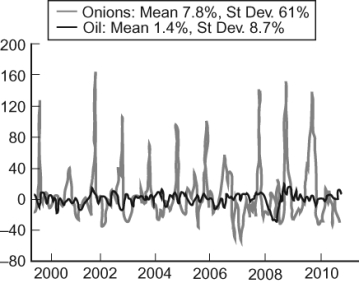

Figure: Price Changes  The figure (from Global Financial Data, EIA) illustrates in percentage terms how the price of onions (in gray) and crude oil (in black) fluctuate over time. The price of onions clearly fluctuates more than oil. In 1958, the United States Congress banned future markets on onions. How does this historical fact explain the difference in deviation between oil and onions?

The figure (from Global Financial Data, EIA) illustrates in percentage terms how the price of onions (in gray) and crude oil (in black) fluctuate over time. The price of onions clearly fluctuates more than oil. In 1958, the United States Congress banned future markets on onions. How does this historical fact explain the difference in deviation between oil and onions?

A) The ban prevented analysts from buying and selling based on the price of onions' current supply and demand.

B) The ban encouraged speculation on the onion, causing its price to fluctuate widely as different bubbles grew and popped.

C) The ban destroyed any incentive for market participants to understand the onion industry.

D) The ban forced market participants to buy and sell based solely on current supply and demand.

Correct Answer:

Verified

Correct Answer:

Verified

Q77: The central planning approach fails to achieve

Q78: Which scenario shows a relatively noisy signal

Q79: Speculators often raise prices today but lower

Q80: Use the following to answer questions:<br>Figure: Hollywood

Q81: When oil prices increased in the 1970s,

Q83: Futures markets largely _ risk.<br>A) do not

Q84: Central planning of resource allocation:<br>A) was attempted

Q85: If an increase in oil prices made

Q86: Failing to understand the signaling role of

Q87: Markets are linked in unpredictable and creative