Multiple Choice

Use the following to answer questions:

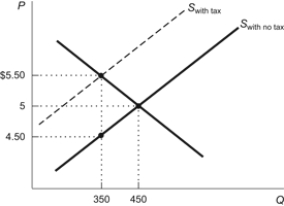

Figure: Tax on Sellers of Gadgets

-(Figure: Tax on Sellers of Gadgets) According to the figure, what is the amount of the tax that has been imposed on the sale of gadgets?

A) $0.50

B) $1.00

C) $1.50

D) $5.50

Correct Answer:

Verified

Correct Answer:

Verified

Q142: If the elasticity of demand is 2

Q143: If the elasticity of supply is 3

Q144: Use the following to answer questions:<br>Figure: Tax

Q145: As supply becomes more elastic, ceteris paribus,

Q146: With a subsidy to consumers, supply:<br>A) increases.<br>B)

Q148: Figure Subsidy Wedge <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3377/.jpg" alt="Figure Subsidy

Q149: A subsidy targeted to raise consumption by

Q150: 3D printing is an exciting new manufacturing

Q151: Which of the following is correct concerning

Q152: If a tax is imposed on sellers