Multiple Choice

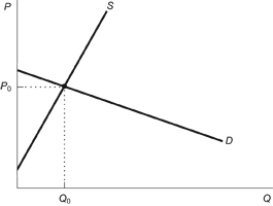

Figure: Commodity Tax with Elastic Demand  According to the figure, who bears the greater burden of a commodity tax?

According to the figure, who bears the greater burden of a commodity tax?

A) The buyer will bear the greater burden of the tax.

B) The seller will bear the greater burden of the tax.

C) The buyer and the seller will split the tax burden equally.

D) The government will bear the full burden of the tax.

Correct Answer:

Verified

Correct Answer:

Verified

Q115: Ceteris paribus, the total subsidy is largest

Q116: A wage subsidy would:<br>A) decrease the demand

Q117: For a given set of supply and

Q118: A commodity tax increases gains from trade.

Q119: When a tax is imposed on consumers

Q121: Use the following to answer questions:<br>Figure: Supply

Q122: According to economic theory, consumers should support

Q123: Which of the following statements is TRUE?

Q124: Let the price elasticity of supply for

Q125: Use the following to answer questions:<br>Figure: Imposition