Multiple Choice

Use the following to answer questions:

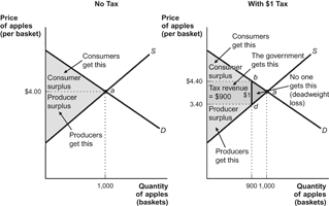

Figure: Consumer and Producer Surplus

-(Figure: Consumer and Producer Surplus) According to the figure, what would happen to the deadweight loss if the tax increased to $2 per basket of apples?

A) The new tax would minimize deadweight loss.

B) Deadweight loss does not change due to a change in the tax.

C) Deadweight loss will decrease due to a change in the tax.

D) Deadweight loss will increase.

Correct Answer:

Verified

Correct Answer:

Verified

Q191: Figure: Commodity Tax <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3377/.jpg" alt="Figure: Commodity

Q192: If it previously existed, a tax decreases

Q193: Use the following to answer questions:<br>Figure: Consumer

Q194: If there is a tax on both

Q195: Which of the following statements is correct?<br>A)

Q197: A government's decision to subsidize the production

Q198: Use the following to answer questions:<br>Figure: Tax

Q199: Use the following to answer questions:<br>Figure: Tax

Q200: Subsidies must ultimately be paid for through

Q201: Use the following to answer questions:<br>Figure: Soda