Essay

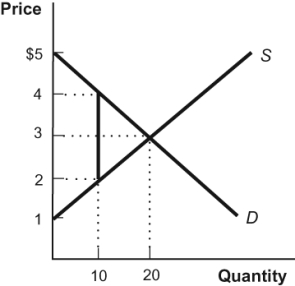

Figure: Tax

Refer to figure. After instituting a $2 tax on the market in this figure, calculate the loss in consumer surplus, the loss in producer surplus, the government's revenue from the tax, and the area of deadweight loss.

Correct Answer:

Verified

Consumer surplus BEFORE the tax was equa...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q17: Figure: Two Demand Curves <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3377/.jpg" alt="Figure:

Q18: The government can choose between taxing buyers

Q19: If the demand curve for a good

Q20: Figure: Tax on Consumers of Gadgets <img

Q21: Use the following to answer questions:<br>Figure: Soda

Q23: Who bears the majority of the burden

Q24: Figure: Two Demand Curves <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3377/.jpg" alt="Figure:

Q25: Which of the following statements is TRUE?<br>I.

Q26: Whether buyers or sellers bear the majority

Q27: Use the following to answer questions:<br>Figure: Commodity