Short Answer

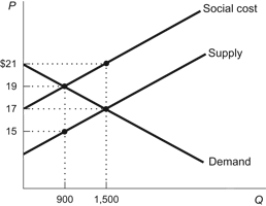

Figure: Negative Externality

The figure shows the market for a good that causes a negative externality when consumed. The government decides to begin taxing its producers. Using the information provided in the figure, answer the following questions.

a. What is the market quantity in this market?

b. What is the social cost of the product?

c. When the product is taxed, what is the dollar amount of the deadweight loss that is removed from the market?

d. What is the new efficient quantity in this market after the tax has been imposed?

Correct Answer:

Verified

a. 1,500

b...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

b...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q26: While the Coase theorem is appealing, private

Q27: Suppose Winston's loud music externalizes a cost

Q28: When the government intervenes in markets with

Q31: Using a demand and supply diagram, demonstrate

Q32: Edgar's expected private benefit from the flu

Q33: An external cost is a cost paid

Q34: When external benefits are present in a

Q35: Command and control policies ensure economic efficiency.

Q46: One advantage of regulation as a method

Q139: Government intervention is necessary to correct all