Multiple Choice

A five-year lease is signed by the City of Wachovia for equipment with a seven-year life. The asset will be returned to the lessor at the end of the lease. The present value of the lease is $20,000, and annual payments of $5,411.41 are payable beginning on the date the lease is signed. The interest portion of the second payment is $1,604.75. The equipment is to be used in City Hall and was purchased from appropriated funds of the General Fund.

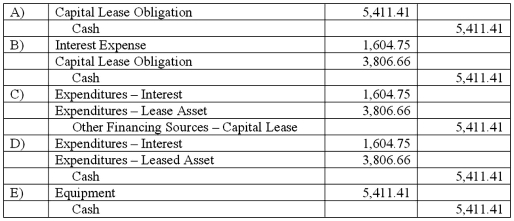

What entry should be made for the government-wide financial statements one year from the date the lease is signed?

A) Option A

B) Option B

C) Option C

D) Option D

E) Option E

Correct Answer:

Verified

Correct Answer:

Verified

Q3: The City of Wetteville has a fiscal

Q9: Which criteria must be met to be

Q17: What information is required in the financial

Q21: The City of Kamen maintains a collection

Q21: What are the three broad sections of

Q28: Marie Todd works for the City of

Q37: According to the GASB (Governmental Accounting Standards

Q42: Which of the following is a section

Q44: What are the three broad sections of

Q50: Jones College, a public institution of higher