Multiple Choice

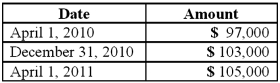

On April 1, 2010, Shannon Company, a U.S. company, borrowed 100,000 euros from a foreign bank by signing an interest-bearing note due April 1, 2011. The dollar value of the loan was as follows:

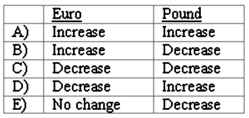

Angela, Inc., a U.S. company, had a euro receivable from exports to Spain and a British pound payable resulting from imports from England. Angela recorded foreign exchange gain related to both its euro receivable and pound payable. Did the foreign currencies increase or decrease in dollar value from the date of the transaction to the settlement date?

A) Option A

B) Option B

C) Option C

D) Option D

E) Option E

Correct Answer:

Verified

Correct Answer:

Verified

Q14: Which of the following approaches is used

Q34: A forward contract may be used for

Q71: Winston Corp., a U.S. company, had the

Q80: What happens when a U.S. company sells

Q83: Brisco Bricks purchases raw material from its

Q87: Coyote Corp. (a U.S. company in Texas)

Q88: The forward rate may be defined as<br>A)

Q90: Coyote Corp. (a U.S. company in Texas)

Q91: Coyote Corp. (a U.S. company in Texas)

Q103: What happens when a U.S. company sells