Multiple Choice

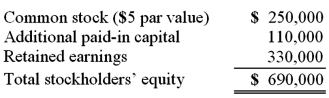

On January 1, 2011, Riney Co. owned 80% of the common stock of Garvin Co. On that date, Garvin's stockholders' equity accounts had the following balances:

The balance in Riney's Investment in Garvin Co. account was $552,000, and the non-controlling interest was $138,000. On January 1, 2011, Garvin Co. sold 10,000 shares of previously unissued common stock for $15 per share. Riney did not acquire any of these shares.

What is the balance in Investment in Garvin Co. after the sale of the 10,000 shares of common stock?

A) $552,000.

B) $560,000.

C) $460,000.

D) $404,000.

E) $672,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q18: Panton, Inc. acquired 18,000 shares of Glotfelty

Q19: Pursley, Inc. owns 70 percent of Harry,

Q20: Ryan Company owns 80% of Chase Company.

Q23: The balance sheets of Butler, Inc. and

Q25: Webb Company owns 90% of Jones Company.

Q40: Campbell Inc. owned all of Gordon Corp.

Q47: A company had common stock with a

Q66: The following information has been taken from

Q77: Fargus Corporation owned 51% of the voting

Q101: How would consolidated earnings per share be