Multiple Choice

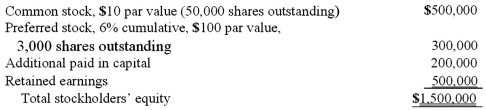

On January 1, 2009, Nichols Company acquired 80% of Smith Company's common stock and 40% of its non-voting, cumulative preferred stock. The consideration transferred by Nichols was $1,200,000 for the common and $124,000 for the preferred. Any excess acquisition-date fair value over book value is considered goodwill. The capital structure of Smith immediately prior to the acquisition is:

Compute the non-controlling interest in Smith at date of acquisition.

A) $486,000.

B) $480,000.

C) $300,000.

D) $150,000.

E) $120,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q28: Davidson, Inc. owns 70 percent of the

Q36: Where do intra-entity sales of inventory appear

Q69: On January 1, 2011, Riley Corp. acquired

Q80: During 2011, Parent Corporation purchased at book

Q91: The following information has been taken from

Q94: Jet Corp. acquired all of the outstanding

Q97: On January 1, 2011, Bast Co. had

Q99: Thomas Inc. had the following stockholders' equity

Q101: Anderson, Inc. has owned 70% of its

Q102: The balance sheets of Butler, Inc. and