Multiple Choice

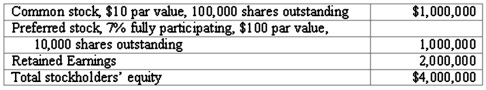

On January 1, 2011, Harrison Corporation spent $2,600,000 to acquire control over Involved, Inc. This price was based on paying $750,000 for 30 percent of Involved's preferred stock, and $1,850,000 for 80 percent of its outstanding common stock. As of the date of the acquisition, Involved's stockholders' equity accounts were as follows:

Assuming Involved's accounts are correctly valued within the company's financial statements, what amount of goodwill should be recognized for the Investment in Involved?

A) $(100,000.)

B) $0.

C) $200,000.

D) $812,500.

E) $2,112,500.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Which of the following statements is false

Q9: The following information has been taken from

Q33: Thomas Inc. had the following stockholders' equity

Q45: Which of the following characteristics is not

Q66: The following information has been taken from

Q72: Franklin Corporation owns 90 percent of the

Q74: Fargus Corporation owned 51% of the voting

Q99: A subsidiary issues new shares of common

Q101: How would consolidated earnings per share be

Q108: Fargus Corporation owned 51% of the voting