Essay

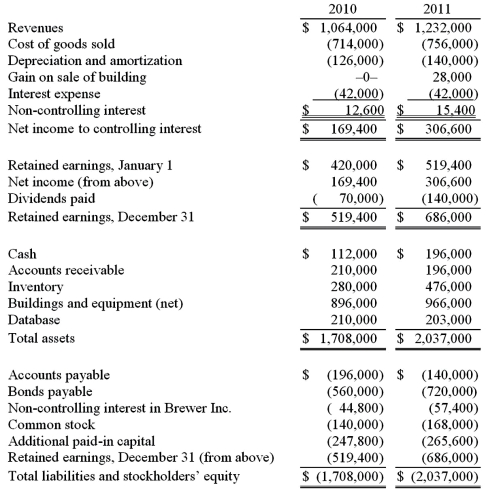

Allen Co. held 80% of the common stock of Brewer Inc. and 40% of this subsidiary's convertible bonds. The following consolidated financial statements were for 2010 and 2011.

Additional Information:

1. Bonds were issued during 2011 by the parent for cash.

2. Amortization of a database acquired in the original combination amounted to $7,000 per year.

3. A building with a cost of $84,000 but a $42,000 book value was sold by the parent for cash on May 11, 2011.

4. Equipment was purchased by the subsidiary on July 23, 2011, using cash.

5. Late in November 2011, the parent issued common stock for cash.

6. During 2011, the subsidiary paid dividends of $14,000.

Required:

Prepare a consolidated statement of cash flows for this business combination for the year ending December 31, 2011. Either the direct method or the indirect method may be used.

Correct Answer:

Verified

The above statement uses the direct me...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

The above statement uses the direct me...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: Parent Corporation acquired some of its subsidiary's

Q15: Fargus Corporation owned 51% of the voting

Q44: The following information has been taken from

Q56: Which of the following is not a

Q73: Parker owned all of Odom Inc. Although

Q84: A variable interest entity can take all

Q86: On January 1, 2009, Nichols Company acquired

Q98: Tray Co. reported current earnings of $560,000

Q107: All of the following are examples of

Q113: Keenan Company has had bonds payable of