Multiple Choice

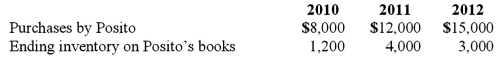

Gargiulo Company, a 90% owned subsidiary of Posito Corporation, sells inventory to Posito at a 25% profit on selling price. The following data are available pertaining to intra-entity purchases. Gargiulo was acquired on January 1, 2010.

Assume the equity method is used. The following data are available pertaining to Gargiulo's income and dividends.

Compute the equity in earnings of Gargiulo reported on Posito's books for 2010.

A) $63,000.

B) $62,730.

C) $63,270.

D) $70,000.

E) $62,700.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Walsh Company sells inventory to its subsidiary,

Q8: Stark Company, a 90% owned subsidiary of

Q9: Stiller Company, an 80% owned subsidiary of

Q52: Pepe, Incorporated acquired 60% of Devin Company

Q53: How is the gain on an intra-entity

Q55: Why do intra-entity transfers between the component

Q63: Stark Company, a 90% owned subsidiary of

Q79: On January 1, 2011, Musial Corp. sold

Q89: Wilson owned equipment with an estimated life

Q92: Gargiulo Company, a 90% owned subsidiary of