Multiple Choice

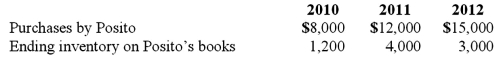

Gargiulo Company, a 90% owned subsidiary of Posito Corporation, sells inventory to Posito at a 25% profit on selling price. The following data are available pertaining to intra-entity purchases. Gargiulo was acquired on January 1, 2010.

Assume the equity method is used. The following data are available pertaining to Gargiulo's income and dividends.

Compute the non-controlling interest in Gargiulo's net income for 2012.

A) $9,400.

B) $9,375.

C) $9,425.

D) $9,325.

E) $8,485.

Correct Answer:

Verified

Correct Answer:

Verified

Q15: How do upstream and downstream inventory transfers

Q25: Gargiulo Company, a 90% owned subsidiary of

Q30: Strickland Company sells inventory to its parent,

Q33: Stark Company, a 90% owned subsidiary of

Q76: Parent sold land to its subsidiary for

Q78: Stiller Company, an 80% owned subsidiary of

Q94: What is the impact on the noncontrolling

Q96: For each of the following situations (1

Q103: Pepe, Incorporated acquired 60% of Devin Company

Q117: Patti Company owns 80% of the common