Multiple Choice

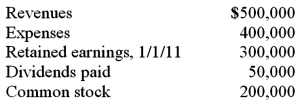

Keefe, Inc., a calendar-year corporation, acquires 70% of George Company on September 1, 2010, and an additional 10% on January 1, 2011. Total annual amortization of $6,000 relates to the first acquisition. George reports the following figures for 2011:

Without regard for this investment, Keefe independently earns $300,000 in net income during 2011.

All net income is earned evenly throughout the year.

What is the controlling interest in consolidated net income for 2011?

A) $380,000.

B) $375,200.

C) $375,800.

D) $376,000.

E) $400,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: In measuring non-controlling interest at the date

Q19: Pell Company acquires 80% of Demers Company

Q20: Pell Company acquires 80% of Demers Company

Q22: On January 1, 2011, John Doe Enterprises

Q23: McGuire Company acquired 90 percent of Hogan

Q25: Pell Company acquires 80% of Demers Company

Q27: Pell Company acquires 80% of Demers Company

Q62: Caldwell Inc. acquired 65% of Club Corp.

Q99: When Jolt Co. acquired 75% of the

Q107: How does a parent company account for