Multiple Choice

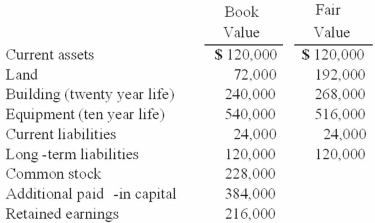

On January 1, 2010, Cale Corp. paid $1,020,000 to acquire Kaltop Co. Kaltop maintained separate incorporation. Cale used the equity method to account for the investment. The following information is available for Kaltop's assets, liabilities, and stockholders' equity accounts:

Kaltop earned net income for 2010 of $126,000 and paid dividends of $48,000 during the year.

In Cale's accounting records, what amount would appear on December 31, 2010 for equity in subsidiary earnings?

A) $77,000.

B) $79,000.

C) $125,000.

D) $127,000.

E) $81,800.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: One company acquires another company in a

Q50: Kaye Company acquired 100% of Fiore Company

Q56: Utah Inc. acquired all of the outstanding

Q62: Pritchett Company recently acquired three businesses, recognizing

Q64: Perry Company acquires 100% of the stock

Q67: Beatty, Inc. acquires 100% of the voting

Q76: Goehler, Inc. acquires all of the voting

Q80: Goehler, Inc. acquires all of the voting

Q113: Why is push-down accounting a popular internal

Q122: What accounting method requires a subsidiary to