Multiple Choice

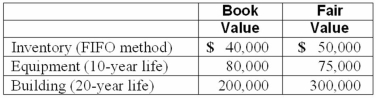

Watkins, Inc. acquires all of the outstanding stock of Glen Corporation on January 1, 2010. At that date, Glen owns only three assets and has no liabilities:

If Watkins pays $450,000 in cash for Glen, what amount would be represented as the subsidiary's Building in a consolidation at December 31, 2012, assuming the book value of the building at that date is still $200,000?

A) $200,000.

B) $285,000.

C) $290,000.

D) $295,000.

E) $300,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q31: Under the partial equity method, the parent

Q35: For an acquisition when the subsidiary retains

Q38: Under the initial value method, when accounting

Q45: What is the basic objective of all

Q61: Harrison, Inc. acquires 100% of the voting

Q69: All of the following are acceptable methods

Q73: Which of the following will result in

Q89: Kaye Company acquired 100% of Fiore Company

Q115: When a company applies the partial equity

Q120: Watkins, Inc. acquires all of the outstanding