Multiple Choice

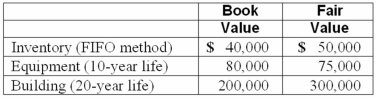

Watkins, Inc. acquires all of the outstanding stock of Glen Corporation on January 1, 2010. At that date, Glen owns only three assets and has no liabilities:

If Watkins pays $300,000 in cash for Glen, at what amount would the subsidiary's Building be represented in a January 2, 2010 consolidation?

A) $200,000.

B) $225,000.

C) $273,000.

D) $279,000.

E) $300,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Dutch Co. has loaned $90,000 to its

Q17: Pritchett Company recently acquired three businesses, recognizing

Q19: Following are selected accounts for Green Corporation

Q21: Matthews Co. acquired all of the common

Q21: Kaye Company acquired 100% of Fiore Company

Q23: On January 1, 2010, Cale Corp. paid

Q24: Red Co. acquired 100% of Green, Inc.

Q26: Jans Inc. acquired all of the outstanding

Q33: Beatty, Inc. acquires 100% of the voting

Q100: Harrison, Inc. acquires 100% of the voting