Multiple Choice

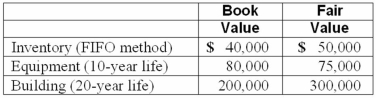

Watkins, Inc. acquires all of the outstanding stock of Glen Corporation on January 1, 2010. At that date, Glen owns only three assets and has no liabilities:

If Watkins pays $450,000 in cash for Glen, at what amount would Glen's Inventory acquired be represented in a December 31, 2010 consolidated balance sheet?

A) $40,000.

B) $50,000.

C) $0.

D) $10,000.

E) $90,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q41: Fesler Inc. acquired all of the outstanding

Q46: Perry Company acquires 100% of the stock

Q48: Following are selected accounts for Green Corporation

Q48: Under the partial equity method of accounting

Q48: On January 1, 2010, Jumper Co. acquired

Q50: When a company applies the partial equity

Q50: Kaye Company acquired 100% of Fiore Company

Q56: Utah Inc. acquired all of the outstanding

Q89: According to GAAP regarding amortization of goodwill

Q104: Cashen Co. paid $2,400,000 to acquire all