Multiple Choice

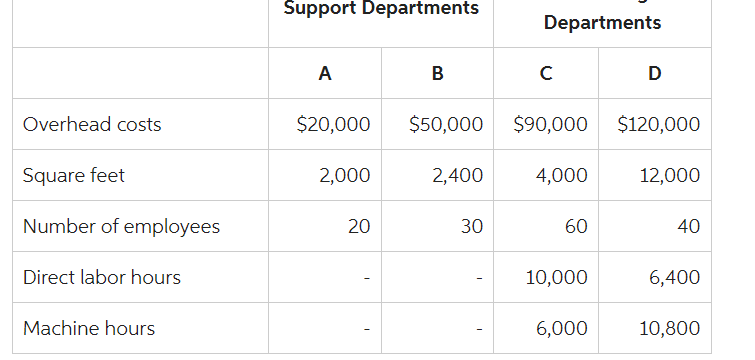

Lopez Manufacturing prices its products at full cost plus 40 percent.The company operates two support departments and two producing departments.Budgeted costs and normal activity levels are as follows:  Support Department A's costs are allocated based on square feet, and Support Department B's costs are allocated based on number of employees.Department C uses direct labor hours to assign overhead costs to products, while Department D uses machine hours.

Support Department A's costs are allocated based on square feet, and Support Department B's costs are allocated based on number of employees.Department C uses direct labor hours to assign overhead costs to products, while Department D uses machine hours.

One of the products the company produces requires 4 direct labor hours per unit in Department C and no time in Department D. Direct materials for the product cost $45 per unit, and direct labor is $20 per unit.

If the sequential method of allocation is used and the company follows its usual pricing policy, the selling price of the product would be (round service allocations to the nearest whole dollar and the costs per unit to two decimal places)

A) $108.46.

B) $113.52.

C) $159.38.

D) $162.52.

Correct Answer:

Verified

Correct Answer:

Verified

Q56: Duff Company uses a job-order costing system

Q58: Plants Company has two support departments (S1

Q59: Which of the following methods allocates joint

Q60: Dean Manufacturing Company has two support departments,

Q62: Maddux Company manufactures products X, Y, and

Q63: Figure 7-6 Oaks Company has two support

Q65: The major objective(s) of allocations are<br>A) to

Q66: Which of the following methods allocates support

Q129: Which of the following cost categories would

Q146: Compare and contrast the various methods of