Multiple Choice

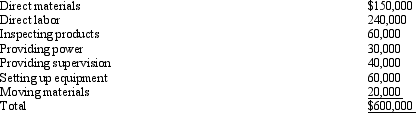

Foster Industries manufactures 20,000 components per year.The manufacturing cost of the components was determined as follows:  If the component is not produced by Foster, inspection of products and provision of power costs will only be 10 percent of the production costs; moving materials costs and setting up equipment costs will only be 50 percent of the production costs; and supervision costs will amount to only 40 percent of the production amount.An outside supplier has offered to sell the component for $25.50.

If the component is not produced by Foster, inspection of products and provision of power costs will only be 10 percent of the production costs; moving materials costs and setting up equipment costs will only be 50 percent of the production costs; and supervision costs will amount to only 40 percent of the production amount.An outside supplier has offered to sell the component for $25.50.

What is the effect on income if Foster Industries purchases the component from the outside supplier?

A) $25,000 increase

B) $45,000 increase

C) $90,000 decrease

D) $90,000 increase

Correct Answer:

Verified

Correct Answer:

Verified

Q23: Upfront resource spending<br>A) is always relevant because

Q31: _ are future costs that differ across

Q33: Figure 17-1 The following information pertains to

Q36: Which of the following costs is NOT

Q39: Walton Company manufactures a product with the

Q40: Reggie Corporation manufactures a single product with

Q43: Miller Company produces speakers for home stereo

Q54: Which of the following items would be

Q64: Meco Company produces a product that has

Q94: Qualitative factors that should be considered when