Multiple Choice

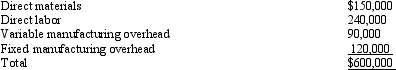

Foster Industries manufactures 20,000 components per year.The manufacturing cost of the components was determined as follows:  An outside supplier has offered to sell the component for $25.50.

An outside supplier has offered to sell the component for $25.50.

Foster Industries can rent its unused manufacturing facilities for $45,000 if it purchases the component from the outside supplier.

What is the effect on income if Foster purchases the component from the outside supplier?

A) $45,000 increase

B) $15,000 increase

C) $75,000 decrease

D) $105,000 increase

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Which of the following costs is NOT

Q22: What are relevant costs? How do they

Q64: A purchasing agent has two potential firms

Q69: Sound tactical decision making<br>A)only concerns the short

Q89: Figure 17-2 Walton Company manufactures a product

Q90: Harris Company uses 5,000 units of part

Q92: Meco Company produces a product that has

Q93: The operations of Grant Corporation are divided

Q99: Sunk costs are<br>A)future costs that have no

Q104: A decision that focuses on whether a