Multiple Choice

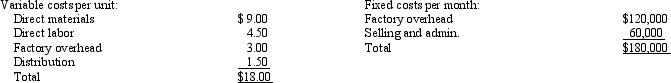

Miller Company produces speakers for home stereo units.The speakers are sold to retail stores for $30.Manufacturing and other costs are as follows:  The variable distribution costs are for transportation to the retail stores.The current production and sales volume is 20,000 per year.Capacity is 25,000 units per year.

The variable distribution costs are for transportation to the retail stores.The current production and sales volume is 20,000 per year.Capacity is 25,000 units per year.

A Tennessee manufacturing firm has offered a one-year contract to supply speaker parts at a cost of $6.00 per unit.If Miller Company accepts the offer, it will be able to reduce variable costs by 30 percent and rent unused space to an outside firm for $18,000 per year.All other information remains the same as the original data.

-What is the effect on profits if Miller Company buys from the Tennessee firm?

A) decrease of $19,000

B) increase of $19,000

C) increase of $13,000

D) increase of $6,000

Correct Answer:

Verified

Correct Answer:

Verified

Q21: The following information pertains to Dodge Company's

Q22: Salda Industries employs 500 workers in the

Q23: Boone Products had the following unit costs:

Q24: Reggie Corporation manufactures a single product with

Q26: Information about three joint products follows: <img

Q28: The operations of Knickers Corporation are divided

Q29: A decision to make or eliminate an

Q30: The following information pertains to Ewing Company's

Q61: Future costs that differ across alternatives describe<br>A)relevant

Q83: The use of relevant cost data to