Multiple Choice

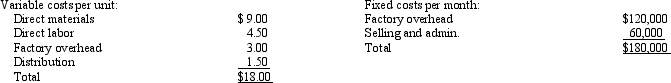

Miller Company produces speakers for home stereo units.The speakers are sold to retail stores for $30.Manufacturing and other costs are as follows:  The variable distribution costs are for transportation to the retail stores.The current production and sales volume is 20,000 per year.Capacity is 25,000 units per year.

The variable distribution costs are for transportation to the retail stores.The current production and sales volume is 20,000 per year.Capacity is 25,000 units per year.

A Tennessee manufacturing firm has offered a one-year contract to supply speaker parts at a cost of $16.00 per unit.If Miller Company accepts the offer, it will be able to rent unused space to an outside firm for $18,000 per year.All other information remains the same as the original data.

-What is the effect on profits if Miller Company buys from the Tennessee firm?

A) decrease of $19,000

B) increase of $19,000

C) increase of $38,000

D) decrease of $6,000

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Firms may be asked to accept a

Q30: Which of the following costs is relevant

Q37: The Titanic hit an iceberg and sank.

Q47: Which of the following items would be

Q82: Information about three joint products follows: <img

Q83: Arcadia, Inc., uses a joint process to

Q85: Given the following three situations:<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2043/.jpg"

Q86: Foster Industries manufactures 20,000 components per year.The

Q89: Figure 17-2 Walton Company manufactures a product

Q104: A decision that focuses on whether a