Multiple Choice

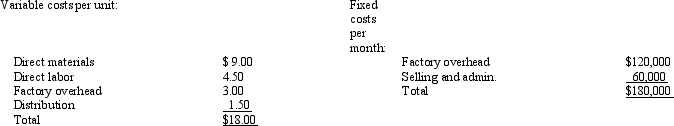

Miller Company produces speakers for home stereo units.The speakers are sold to retail stores for $30.Manufacturing and other costs are as follows:  The variable distribution costs are for transportation to the retail stores.The current production and sales volume is 20,000 per year.Capacity is 25,000 units per year.

The variable distribution costs are for transportation to the retail stores.The current production and sales volume is 20,000 per year.Capacity is 25,000 units per year.

-

A San Diego wholesaler has proposed to place a special one-time order of 10,000 units at a reduced price of $24 per unit.The wholesaler would pay all distribution costs, but there would be additional fixed selling and administrative costs of $3,000.All other information remains the same as the original data.What is the effect on profits if the special order is accepted?

A) increase of $75,000

B) increase of $57,000

C) decrease of $168,000

D) increase of $12,000

Correct Answer:

Verified

Correct Answer:

Verified

Q21: Relevant costs are<br>A)past costs.<br>B)future costs.<br>C)full costs.<br>D)cost drivers.

Q52: Mickey Company manufactures three joint products: X,

Q53: Manning Company uses a joint process to

Q54: Barron Company's 2011 income statement is as

Q56: The following information relates to a product

Q58: Figure 17-2 Walton Company manufactures a product

Q60: Boone Products had the following unit costs:

Q61: The steps in the tactical decision making

Q62: Figure 17-1 The following information pertains to

Q65: An important qualitative factor to consider regarding