Essay

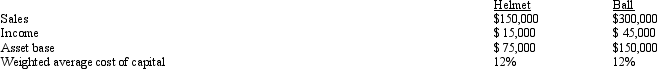

Stevens Company has two divisions that report on a decentralized basis.Their results for 2011 were as follows:

Required:

Required:

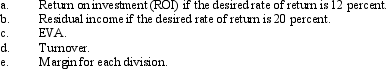

Compute the following amounts for each division:

Correct Answer:

Verified

_TB2043_00...

_TB2043_00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: Given the following information for the Zenith

Q12: _ is after-tax operating profit minus the

Q13: O'Neil Company requires a return on capital

Q15: Correll Company has two divisions, A and

Q18: The Bat Division of Baseball Company has

Q19: The following information pertains to the three

Q47: _ is the delegation of decision-making authority

Q60: Which of the following departments would NOT

Q117: The return on investment is computed as<br>A)operating

Q129: The "floor" in transfer pricing is<br>A)the transfer