Multiple Choice

A five-year lease is signed by the City of Wachovia for equipment with a seven-year life. The asset will be returned to the lessor at the end of the lease. The present value of the lease is $20,000, and annual payments of $5,411.41 are payable beginning on the date the lease is signed. The interest portion of the second payment is $1,604.75. The equipment is to be used in City Hall and was purchased from appropriated funds of the General Fund.

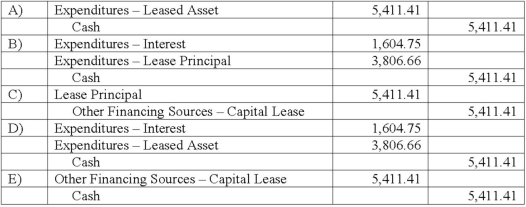

What should be recorded in the General Fund one year from the date the lease is signed?

A) Option A

B) Option B

C) Option C

D) Option D

E) Option E

Correct Answer:

Verified

Correct Answer:

Verified

Q5: What is meant by the term fiscally

Q23: For the purpose of government-wide financial statements,

Q34: What three criteria must be met before

Q40: Which of the following is a financial

Q41: Which one of the following is a

Q42: Which of the following is a section

Q43: A method of depreciation for infrastructure assets

Q47: A city starts a solid waste landfill

Q48: Which statement is false regarding the government-wide

Q49: The Town of Portsmouth has at the