Multiple Choice

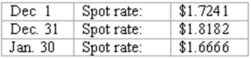

Norton Co., a U.S. corporation, sold inventory on December 1, 2013, with payment of 10,000 British pounds to be received in sixty days. The pertinent exchange rates were as follows:  What amount of foreign exchange gain or loss should be recorded on December 31?

What amount of foreign exchange gain or loss should be recorded on December 31?

A) $300 gain.

B) $300 loss.

C) $0.

D) $941 loss.

E) $941 gain.

Correct Answer:

Verified

Correct Answer:

Verified

Q34: A forward contract may be used for

Q35: Coyote Corp. (a U.S. company in Texas)

Q36: On December 1, 2013, Keenan Company, a

Q37: Mills Inc. had a receivable from a

Q37: Lawrence Company, a U.S.company, ordered parts costing

Q39: Car Corp. (a U.S.-based company) sold parts

Q41: On October 1, 2013, Eagle Company forecasts

Q42: On October 1, 2013, Eagle Company forecasts

Q43: Coyote Corp. (a U.S. company in Texas)

Q44: Car Corp. (a U.S.-based company) sold parts